Basic approach to the environment

Rising average temperatures and sea levels have been observed worldwide, making environmental challenges a truly global concern. The impact of environmental initiatives on corporate activities is expanding, driven by factors such as the government’s declaration of carbon neutrality by 2050 and the growing environmental awareness of stakeholders. We believe that our efforts to preserve the global environment are essential to fulfill our social responsibility and to continue our corporate activities. We will promote environmentally friendly business activities by facilitating M&As in sectors that contribute to climate change, decarbonization, and low-carbon initiatives. In addition, we will work to minimize our environmental footprint by reducing greenhouse gas emissions and waste.

Our Sustainability Promotion Committee is taking the lead in our environmental activities, focusing on addressing climate change in line with TCFD recommendations.

Initiatives to realize a decarbonized society

M&A support that contributes to the environment

By facilitating mergers and acquisitions of companies engaged in solar power generation, solar power sales, and used equipment sales, we contribute to the proliferation of renewable energy and the reduction of waste and greenhouse gas emissions, with the goal of achieving carbon neutrality across society.

Purchase of non-fossil fuel certificates

Since July 2022, we have been purchasing non-fossil fuel certificates to account for the environmental benefits of electricity generated from solar, wind, hydro, and other renewable energy sources at our headquarters, effectively reducing our CO2 emissions to zero.

Introduction of business casual attire

We have implemented business casual attire year-round and adjust air conditioning temperatures in the summer to conserve electricity.

Disclosure based on TCFD recommendations

- Governance

- Strategy

- Risk management

- Indicators and targets

- GHG emissions

- Initiatives to reduce

environmental impact

Governance

We have established the Sustainability Promotion Committee as an organization to identify issues related to sustainability and make company-wide efforts to address them.

In addition to addressing overall sustainability issues relevant to the Sustainable Development Goals (SDGs), the Sustainability Promotion Committee monitors climate-related issues by identifying risks and opportunities, conducting scenario analyses, and calculating greenhouse gas (GHG) emissions as required by the TCFD recommendations, and reporting to the Board of Directors.

The Board of Directors receives reports on the status of efforts to address climate change issues and informs the Sustainability Promotion Committee on the policies that should be adopted to address them.

Strategy

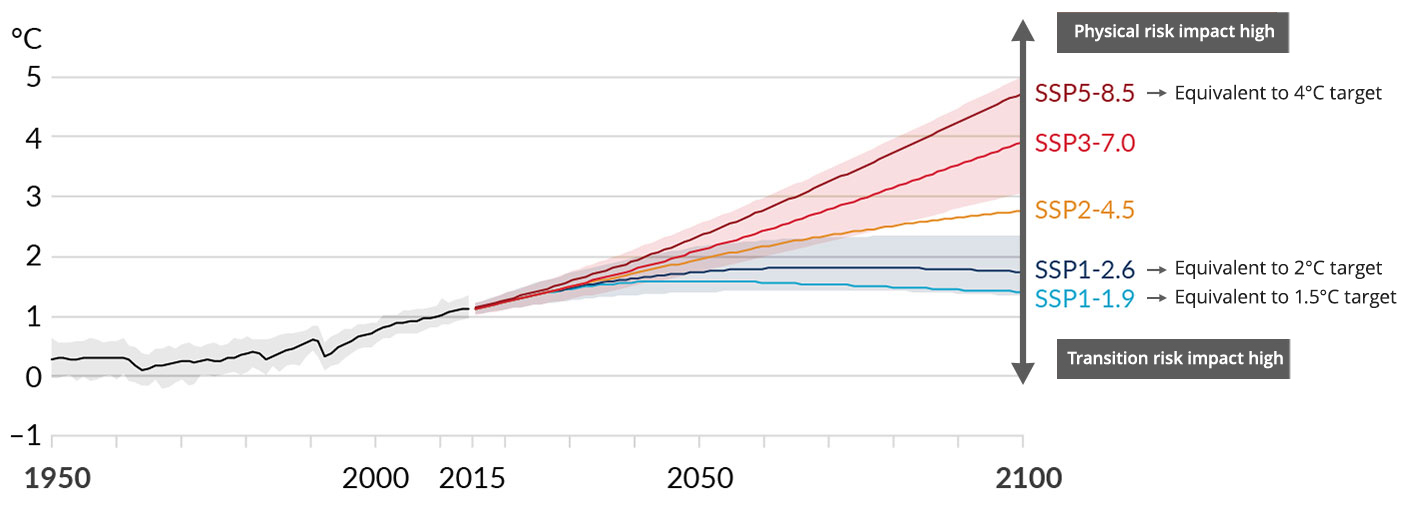

We have identified risks and opportunities that may arise as a result of climate change, in line with the TCFD recommendations, and evaluated their significance. The following scenarios were used to identify the risks and opportunities over the short, medium, and long term (2030, 2050 and 2100, respectively).

- International Energy Agency (IEA) 1.5°C rise (NZE2050), 2°C rise (APS)

- Intergovernmental Panel on Climate Change (IPCC) 1.5°C rise (SSP1), 2°C rise (SSP1, RCP2.6), 4°C rise (SSP5, RCP8.5)

Significance was evaluated by scoring the items in terms of the “degree of certainty” and the “magnitude of impact.”

- Degree of certainty: Judged based on external reports, past impacts, Strike’s plans and policies, etc.

- Magnitude of impact:

Risk: Judged based on severity of impact, impact on major departments, scope of impact, etc.

Opportunity: Judged based on market size, impact on sales, competitive advantage, etc.

The most significant risks and opportunities identified through the above process are listed in the table below.

Significant risks

| Major risks | Impact on business | Significance | Time horizon | Main measures | |||

|---|---|---|---|---|---|---|---|

| 1.5°C/2°C scenario | 4°C scenario | ||||||

| Transition risk | Policy and regulatory risk | Wide-spread adoption of carbon taxes and levies as well as emissions trading schemes | Additional costs will be incurred for carbon taxes and emissions trading related to the use of fossil fuel-derived energy. | Medium | Short- to medium-term | Promote activities to reduce GHG emissions | |

| Costs will increase for emissions trading, purchase of certificates (credits), etc. to achieve the emissions targets as well as administrative procedures for reporting. | Medium | Promote activities to reduce GHG emissions | |||||

| Market risk | Increased environmental awareness of customers regarding climate change | A decrease in investment in companies with environmental risks will result in a decline in sales. | Medium | Promote environmentally friendly business activities | |||

| Physical risk | Acute risk | More frequent and severe disasters due to climate change, such as typhoons, torrential rains, and floods | Business will be suspended if the offices of Strike or its customers (sellers or buyers) are damaged, or if the transportation or information infrastructure connecting them is affected. | Medium to high | Medium-to long-term | Promote disaster prevention and mitigation measures at business sites, adopt remote work and use shared offices | |

| Chronic risk | Sea level rise | Risk of storm surge damage to business sites will increase and additional costs will be incurred for office relocation. | Medium | Relocate business sites, promote disaster prevention and mitigation measures at business sites, adopt remote work and use shared offices | |||

Significant opportunities

| Major opportunities | Impact on business | Significance | Time horizon | Main measures | |||

|---|---|---|---|---|---|---|---|

| 1.5°C/2°C scenario | 4°C scenario | ||||||

| Opportunity | Products/ services | Increased M&A needs of companies developing low-carbon products and services in response to climate change | The increase in the number of companies engaged in the development of low-carbon products and services will boost M&A needs as more companies will start considering M&A. | Medium to high | Short- to medium-term | Identify M&A needs of companies developing low-carbon products and services | |

| Market | Increased M&A needs of companies due to climate change | As decarbonization progresses, more companies (including venture firms) will seek to expand or create businesses in sectors that contribute to decarbonization and low carbon emissions, leading to an increase in M&A needs. | High | Identify M&A needs related to decarbonization and low-carbon business | |||

| As decarbonization progresses, there would be increased need for customers to reduce CO2 emissions in their operations, resulting in a rise in M&A needs. | Medium to high | Identify M&A needs for decarbonization | |||||

| Increased customer awareness of climate change will increase demand for investments in climate change-related businesses and therefore boost M&A needs. | Medium to high | Identify M&A needs related to climate change | |||||

| Growing environmental awareness will further require companies to address ESG-related issues, and an increase in the number of companies considering business closures will lead to an increase in M&A needs. | Medium | Identify M&A needs related to climate change | |||||

| With the setting of transaction terms that consider climate change in the market, more companies will be willing to partner with companies with large capital strength, resulting in an increase in M&A needs. | Medium | Identify M&A needs related to climate change | |||||

Business impact assessment

For the significant risks that could be estimated, we estimated the additional cost of introducing a carbon tax as a transition risk, and the additional cost of addressing the inundation of a business site in the event of flooding or storm surge (office replacement cost) as a physical risk. In the estimation, we used scenarios assuming a temperature rise of 1.5°C/2.0°C and 4°C based on information from the IPCC and the IEA.

Scenario groups used

| Temperature rise zone (2100) | IEA WEO | IPCC RCP | IPCC SSP |

|---|---|---|---|

| 4°C rise | RCP8.5 | SSP5 (fossil fuel dependent) -8.5 | |

| 2°C rise | APS (achieved in all countries that have made a net zero pledge) | RCP2.6 | SSP1 (sustainability-oriented) -2.6 |

| 1.5°C rise | NZE (net zero achieved by 2050) | SSP1 (sustainability-oriented) -1.9 | |

| Events used to estimate financial impact | Introduction of carbon tax | Flood | Storm surge |

Global surface temperature change relative to 1850-1900

Source: Intergovernmental Panel on Climate Change (IPCC) Sixth Assessment Report (AR6) Working Group I Report on Climate Change 2021

(1) Additional costs of introducing a tax system (e.g., carbon tax) <Transition risk>

Based on information from the IEA, we calculated the additional costs that would be incurred with the emissions of greenhouse gases generated from energy consumption at our business sites.

The additional costs were larger under the 1.5°C scenario, with an impact of about 6.3 million yen in 2050. However, this amount is less than 1% of our ordinary profit for the year ended September 30, 2022, indicating that the impact of climate change is smal

| Risk | Scenario | Financial impact (millions of yen) | Financial impact (as a percentage of ordinary profit (%)) |

||

|---|---|---|---|---|---|

| 2030 (Short-term) | 2050 (Medium-term) | 2030 (Short-term) | 2050 (Medium -term) |

||

| Introduction of carbon tax | 1.5°C rise | 3.5 | 6.3 | 0.084 | 0.149 |

| 2°C rise | 3.4 | 5.0 | 0.081 | 0.119 | |

- Method of calculation

Current CO2 emissions x Future carbon tax price

- Future scenarios of carbon tax prices used

We adopted the following scenarios described in World Energy Outlook 2022 provided by the IEA.- 1.5°C rise: Net Zero Emissions by 2050 Scenario (NZE2050)

- 2°C rise: Announced Pledges Scenario (APS)

(2) Additional costs of addressing the inundation of business sites in the event of a storm surge (office replacement cost) <Physical risk>

Using future projection data provided by the IPCC, we calculated the cost of renting alternative office space (additional cost) necessary to continue our operations in the event our business sites are inundated by flooding or storm surge.

As a result of reviewing the current flood and storm surge hazard maps for all our sites, we found no locations that required inundation damage estimation due solely to flooding. Therefore, the estimation was conducted only for sites at risk of inundation damage caused by storm surges.

The additional costs were larger under the 4°C scenario, with an impact of about 24 million yen in 2100. However, this amount is less than 1% of our ordinary profit for the year ended September 30, 2022, indicating that the impact of climate change is small.

| Risk | Scenario | Financial impact (millions of yen) | Financial impact (as a percentage of ordinary profit (%)) |

||||

|---|---|---|---|---|---|---|---|

| 2030 (Short-term) | 2050 (Medium-term) | 2100 (Long-term) | 2030 (Short-term) | 2050 (Medium-term) | 2100 (Long-term) |

||

| Inundation of sites caused by storm surge | 1.5°C rise | 2.617 | 2.631 | 2.838 | 0.062 | 0.062 | 0.067 |

| 2°C rise | 7.458 | 7.458 | 9.066 | 0.176 | 0.176 | 0.215 | |

| 4°C rise | 12.919 | 15.064 | 24.232 | 0.306 | 0.356 | 0.573 | |

- Calculation method

Calculation of additional costs (future - present) due to natural disasters

Office replacement costs of each site are estimated in accordance with the national calculation method based on historical flood damage, using data published by public agencies to determine the inundation depths of the sites in the event of flooding and/or storm surge.

- Future scenarios of inundation depths used

The following scenario provided by the IPCC was adopted.

Storm surge: SSP scenario in the 6th Assessment Report (AR6) (equivalent to 1.5°C, 2°C, and 4°C rises)

Risk management

The management of company-wide risks, including those related to climate change, is overseen by the Director in charge of the Administration Department, and important policies are reported to the Executive Committee and the Board of Directors.

Regarding climate change-related risks, the Sustainability Promotion Committee monitors the overall climate-related issues by identifying climate-related risks and opportunities in line with TCFD recommendations, and reporting to the Board of Directors. Risks and opportunities identified are evaluated in terms of their significance based on the degree of their certainty and the magnitude of their impact, and those evaluated as significant are reported to the Board of Directors and incorporated into the company-wide risk management system.

Indicators and targets

We have been striving to reduce greenhouse gas emissions from our business activities in order to become carbon neutral by 2050. Based on the results of the calculation of greenhouse gas emissions for the fiscal year ended September 30, 2022, we have set the following medium-term targets.

Scope: GHG emissions (Scope 1 + Scope 2)

Target: 50% reduction by FY2030/9 compared to the base year (FY2022/9)

GHG emissions

GHG emissions results for Scope 1, 2 , and 3

Unit: t-CO2

| Classification | FY2022/9 | FY2023/9 | |

|---|---|---|---|

| Scope1+2+3 | Location-based | 2,143 | 7,346 |

| Market-based | 2,176 | 7,250 | |

| Scope 1 (fuel combustion) *1 | 18 | 22 | |

| Scope 2 (electricity use) | Location-based *2 | 95 | 131 |

| Market-based *3 | 128 | 35 | |

| Scope 2 (heat use) | 39 | 75 | |

| Scope 3 (indirect emissions that that occur in the value chain of the reporting company) *4 | 1,991 | 7,117 | |

Subject: Strike Co., Ltd.

Calculation standard: Calculation based on GHG Protocol

Scope of calculation: Scope 1 (fuel combustion), Scope 2 (electricity and heat use), Scope 3 (indirect emissions through the supply chain)

*1: Annual gasoline consumption × Unit calorific value of gasoline × CO2 emission factor for gasoline × 44/12

The unit calorific value of gasoline and the CO2 emission factors for various fuels are based on “System for Calculation, Reporting and Publication of Greenhouse Gas Emissions” under the “Act on Promotion of Global Warming Countermeasures.”

*2: Calculated based on the average emission factor (national average factor).

*3: Calculated based on the adjusted emission factors for each electric utility, as specified in the “Act on Promotion of Global Warming Countermeasures.”

*4: The emission factors are based on values from the “Emission Factor Database for Calculating Greenhouse Gas Emissions of Organizations through the Supply Chain.”

Scope 3 GHG emissions results by category

Unit: t-CO2

| Category | FY2022/9 | FY2023/9 |

|---|---|---|

| 1. Products and services purchased | 1,106 | 3,465 |

| 2. Capital goods | — | 2,595 |

| 3. Fuel and energy related activities not included in Scope 1 and 2 | 33 | 61 |

| 5. Waste generated from business | 0 | 8 |

| 6. Business trip | 806 | 927 |

| 7. Employer commuting | 43 | 58 |

| 8. Leased assets (upstream) *1 | 0 | 0 |

| Total | 1,991 | 7,117 |

Items shown in “-“ are not included in the calculation.

*1: Emissions from rental office use

Initiatives to reduce environmental impact

Reduction of paper consumption

We promote the digitization and transfer of information through data to reduce waste. In addition, efforts are made to reduce paper consumption by introducing an internal decision-making system and an electronic contracting system.

Introduction of environmentally friendly office supplies

For office supplies, we encourage the use of products made from recycled materials, plant-derived plastics, and plastic-free alternatives.