Basic approach to compliance and risk management

To advance our mission and ensure sustainable development, we will not only comply with laws and regulations but also uphold the high ethical standards expected of us and our industry in which we operate and foster an organizational culture that emphasizes compliance.

We will implement comprehensive risk management across the company to prevent unforeseen losses and enhance corporate value. This involves identifying significant risks, taking measures to mitigate them, and establishing a system for prompt communication and sharing of risk-related information.

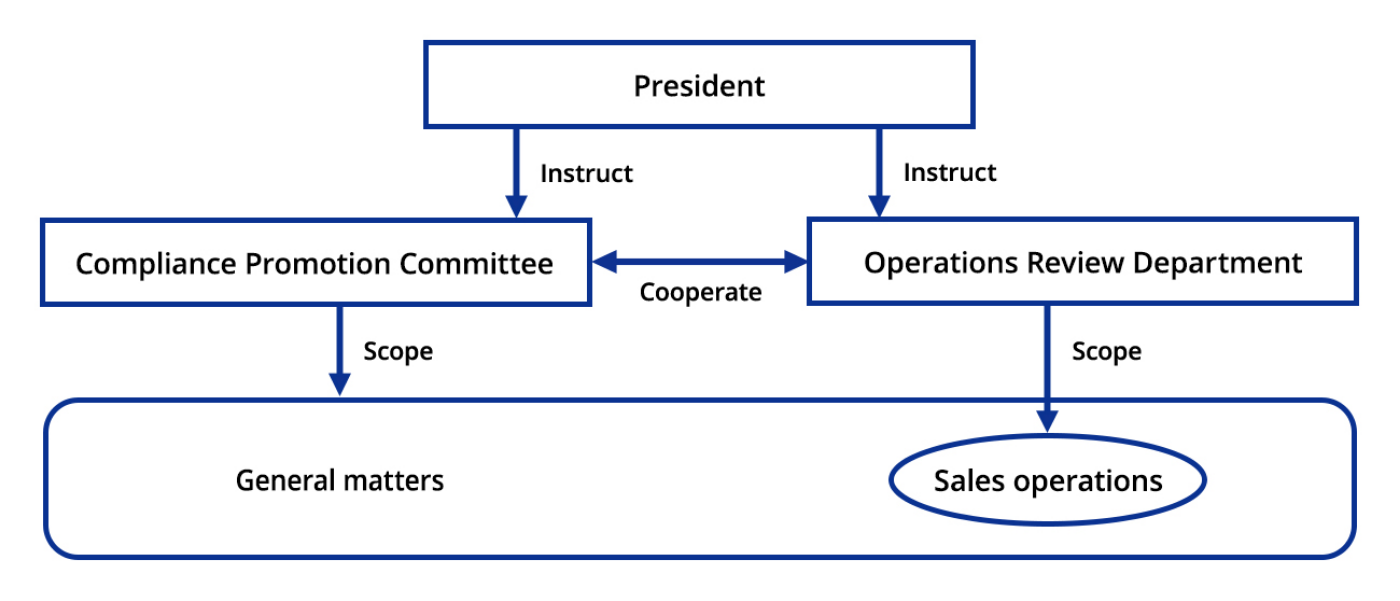

Compliance and risk management promotion structure

The Compliance Promotion Committee plays a central role in compliance and risk management, while sales compliance and risk management matters are handled jointly with the Operations Review Department.

Compliance & Risk Management Promotion Structure

Compliance Promotion Committee

The Company has established a Compliance Promotion Committee to raise awareness of compliance within the Company and promote compliance from a company-wide perspective. Chaired by a full-time director, this five-member Committee meets monthly to discuss and promote compliance initiatives. The committee has jurisdiction over all compliance-related matters.

Operations Review Department

The Operations Review Department, which is independent of the sales departments and reports directly to the President, is responsible for reviewing the sales compliance system, raising employee awareness of compliance issues, and formulating measures to prevent recurrence.

Compliance and risk management initiatives

Compliance and risk management policy

The Compliance Promotion Committee examines important risks and reports them to the Executive Committee, which identifies important risks and discusses and decides on the BCP policy. The Executive Committee also examines and decides on policies for dealing with unexpected risks. Based on the policies decided by the Executive Committee, relevant departments consider and implement specific measures.

Education and information sharing

In principle, compliance education is provided at least once a year to instill compliance awareness among employees. In addition, when important matters arise or when extraordinary action is required, information is shared as appropriate through all hands meetings, morning meetings, and internal communication tools.

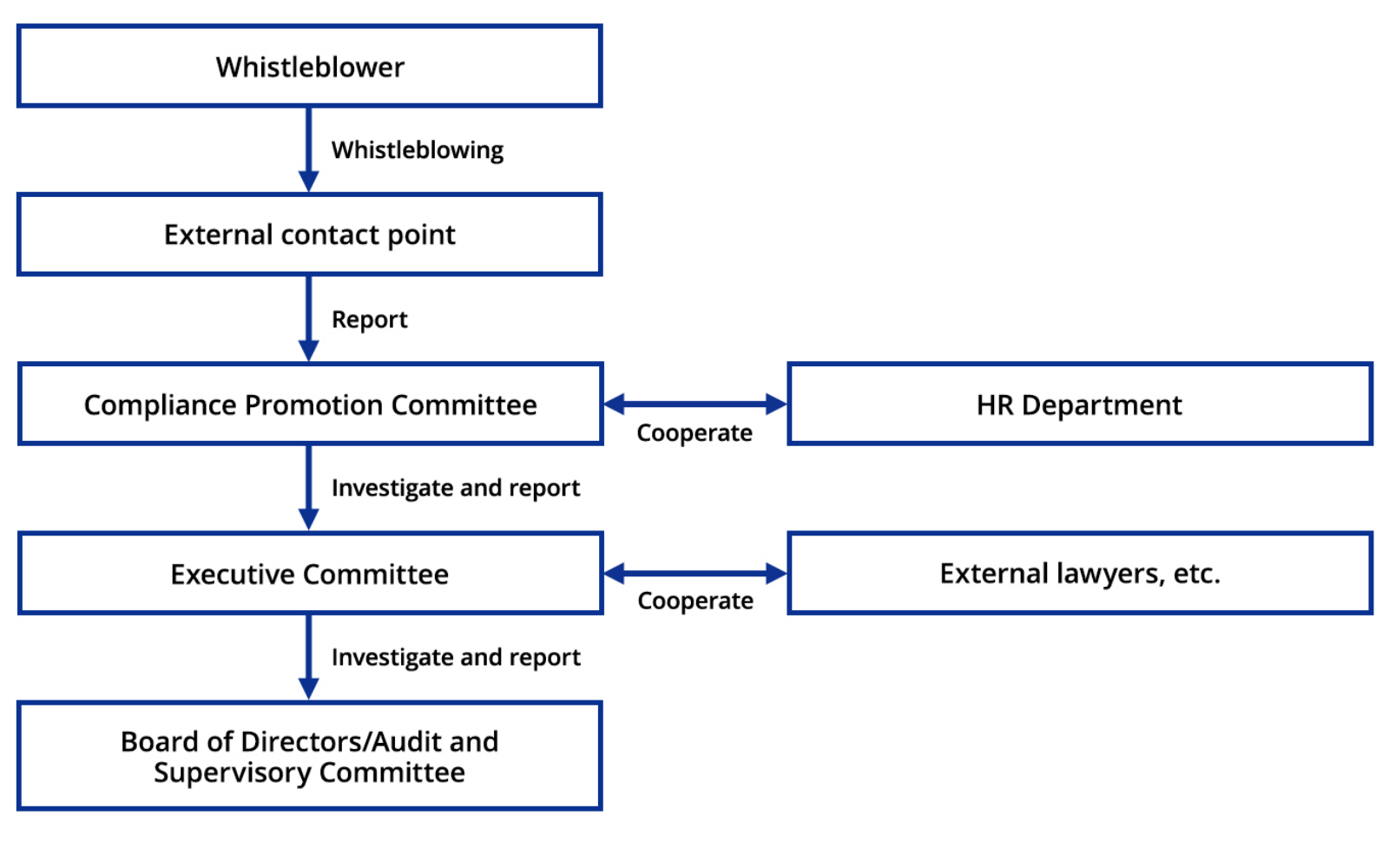

Whistleblowing system

We have established a whistleblowing system to prepare for situations where violations of laws, regulations or rules, or suspected illegal acts have occurred or are likely to occur, and where it is considered difficult or inappropriate to correct or resolve the issue through normal instructions and orders. To ensure that whistleblowers are not easily identified and can report safely and securely, we have outsourced the whistleblower hotline to an external company with no vested interest in our organization.

To protect whistleblowers, we have developed whistleblower protection regulations and share information with the Human Resources Department to ensure whistleblowers are protected from any form of disadvantageous treatment. Additionally, those who engage in retaliatory actions against whistleblowers will be subject to strict disciplinary measures based on our internal regulations, such as employment rules, to prevent any disadvantage to whistleblowers.

In addition to the internal whistleblowing system, we have also set up an external point of contact on our website to receive reports from customers and other stakeholders.

Whistleblowing system

Number of whistleblowing cases

| FY2022/9 | FY2023/9 | FY2024/9 | |

|---|---|---|---|

| Number of whistleblowing cases | 0 | 0 | 2 |

Policies

Anti-Bribery and

Corruption Policy

Strike has established the following Anti-Corruption and Bribery Policy to conduct corporate activities in compliance with laws, regulations, and social norms, and to maintain the trust of society and stakeholders.

Scope of application

This policy applies to all officers and employees of Strike.

Compliance with laws and regulations

Officers and employees of Strike must comply with all applicable anti-corruption and anti-bribery laws and regulations in Japan and in all relevant countries and regions.

Prohibition of offering bribes

Strike’s officers and employees are prohibited from offering or promising to offer any money, goods, or other benefits to public officials, business partners, or others with improper intent.

Prohibition of accepting bribes

Strike’s officers and employees are prohibited from soliciting or accepting any money, goods, or other benefits with improper intent.

Lawful gifts and entertainment, and record keeping

Gifts or entertainment may be provided to business partners, etc. only for legitimate business purposes and within the scope that is reasonable in light of socially accepted norms. In providing entertainment, gifts, or other benefits, necessary procedures must be followed in accordance with internal rules, etc., and accurate records of all transactions must be kept.

Political contributions

In principle, Strike does not make political donations, but if it were to do so, it must comply with all relevant laws and regulations.

Internal reporting system

Strike has a whistleblower hotline that allows employees and officers to report compliance violations, including cases of bribery and corruption. In addition, the Company’s internal regulations stipulate that whistleblowers should be guaranteed confidentiality and that any prejudicial treatment of whistleblowers should be prohibited. If a violation or potential violation by an officer or employee is discovered, an investigation will be conducted, and appropriate actions will be taken, including correction of the violation, disciplinary action against the violator, and formulation of measures to prevent recurrence.

Basic Policy on Antisocial Forces

Strike establishes and complies with this basic policy to resolutely eliminate all ties with antisocial forces that threaten social order and safety (organized crime groups, members of organized crime groups, quasi-constituents of organized crime groups, companies affiliated with organized crime groups, corporate racketeers, etc.).

1. Severing all ties including transactional relationships

We must sever all ties, including transactional relationships, with antisocial forces.

2. Organizational response

The entire organization shall take action against antisocial forces in accordance with a separate internal policy. In addition, we must ensure the safety of the officers and employees who will deal with them.

3. Cooperation with external specialized organizations

We shall establish close cooperative relationships with external specialized organizations such as police, the National Center for Removal of Criminal Organizations, and attorneys to deal with unreasonable demands made by antisocial forces.

4. Legal response in case of emergency

We will not accept any unreasonable demands from antisocial forces, and will take legal action, both civil and criminal, as necessary.

5. Prohibition of providing benefits and engaging in backroom dealing

We will under no circumstances provide benefits to or engage in backroom dealing with antisocial forces.

Tax Policy

Strike is committed to social development and the fulfillment of its mission through fair and honest business activities in compliance with laws, regulations, and rules. With respect to taxation, Strike establishes the following tax policy to ensure tax compliance and tax transparency.

Tax compliance

We will file tax returns and pay taxes in an appropriate and timely manner in accordance with relevant tax laws, regulations, and rules.

Tax governance

Strike’s Director and Chief Financial Officer is responsible for establishing and maintaining tax governance and risk management systems. Day-to-day tax administration is managed by the Administration Department, where issues of particular importance and significant risks are reported to the Board of Directors. In addition, training and other programs are provided to employees as necessary to improve their tax knowledge.

Response to tax risks

We ensure that tax risks are properly managed by making prior inquiries to tax authorities and consulting with experts when tax laws are unclear, have multiple possible interpretations, or in other necessary cases.

Tax planning

We strive to optimize the tax burden by using preferential tax treatment within the scope that is reasonable in light of our business purposes. We do not use tax havens or tax structures for the purpose of tax avoidance.

Relationship with tax authorities

We build and maintain sound relationships with tax authorities. We respond in good faith to inquiries from tax authorities, and if differences of opinion arise, we endeavor to resolve them through constructive dialogue.